Table of Content

The benefits include attractive rates of interest, lower processing fees, up to 80 % coverage of the property amount and a repayment period of up to 20 years. The documentation needed to be submitted along with your home loan application form is available here. This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process.

This, in the long run, enables a person to save more money by claiming deductions in income tax, against the principal and repaid interest amount. DHFL home loans do not finance the entire property value and are subject to the value of property in the market. From quantum of loan to the tenure, DHFL has a variety of options for all types of people. Every customer is important to DHFL and their offerings convey it. For the better service, members should vouch that data supplied on registration are true and complete, and be responsible for all the consequences of false information.

Property related documents

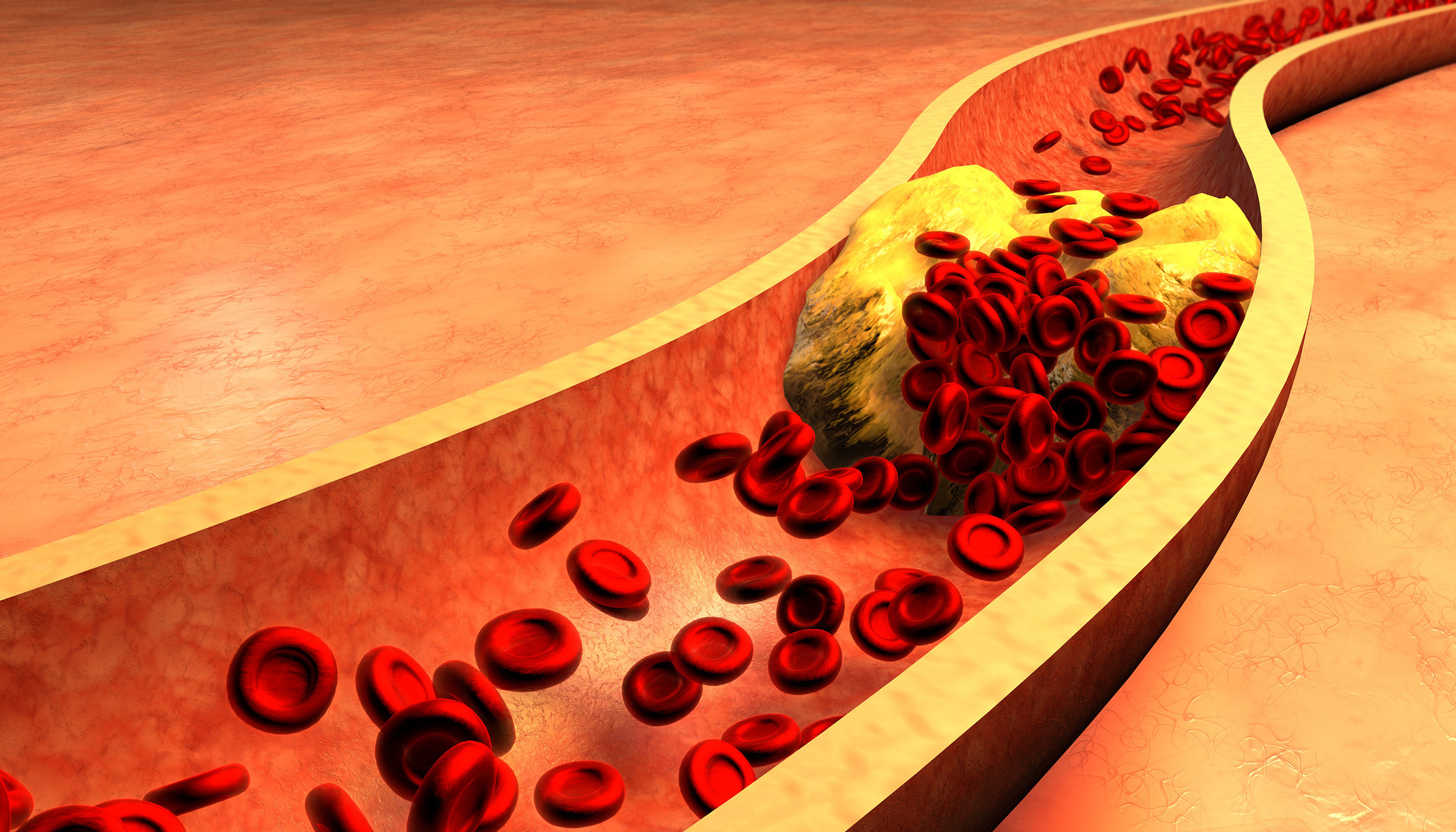

If you have a personal or family history of either high cholesterol levels or C-reactive proteins, talk to your doctor about steps you can take to regularly monitor your HDL levels. You can login to the online portal of DHFL with the help of the username and login password. The service is available for the convenience of the customers who prefer the online process. If you want to know the application status of your DHFL home loan, it is absolutely easy to know the same.

In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. Customers can however also choose to begin their EMIs sooner. The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed. Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. Read the FAQs before starting your loan application process.

HDFC News & Investor's Corner

For all other Home Loan products, the maximum repayment period shall be up to 20 years. Check with the lender if the property that you have shortlisted will be considered for a housing loan. Check your loan eligibility before starting your home loan application. You can download account statements, interest certificates, request for home loan disbursement and do much more. Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries.

You just need to login to the site with your user id and password, and by doing so, you can easily track or know the current status of your home loan application. A smaller housing loan and paying it off early will give you greater financial flexibility for your other goals (e.g. building up retirement funds, investments, etc.). Read more on the conditions to take a second HDB housing loan. Flat buyers’ financial situation Financial ability of flat buyers to service the mortgage instalments, to ensure that they do not borrow beyond their means.

When can I take disbursement of the home loan?

C-reactive proteins are produced by your liver in response to high levels of inflammation in your body. Instead of acting as a protective factor in heart health, high HDL levels in these people could instead increase the risk of heart disease. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. With the help DHFL home loan EMI calculator, it becomes easy for you to calculate your EMI anytime. Get the information you need for any business involving HDB homes, properties, commercial spaces, or land under our management.

Thinking of taking a loan may seem daunting and even if you decide to go through the process to get yourself your own house but there is one thing more which needs to be taken care of – Trust. The applicant is advised to go through all the content carefully and use the Eligibility Calculator to establish his eligibility for that particular home loan type. It is due to these unparalleled benefits that a large number of Non – resident Indians prefer DHFL as their loan providers. If you agree to the Terms of Use, HDL and the website may use your data supplied when providing technique or other services and you may receive email messages from HDL.

HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. However, higher rates of interest and lower loan tenures are far outweighed by the benefits that DHFL Home Loans for NRIs provide.

It’s usually thought that the higher your HDL levels are, the better. But some research shows that high HDL can actually be harmful in certain people. Below are the documents that you must have if you want to apply for a home loan at DHFL. Proper documentation would help you get an instant approval. I agree to defend, indemnify, and hold harmless the Releasee from and against any and all Losses resulting from claims made against TUCL L by third parties arising from and in connection with this letter. Plan for your flat purchase with our ABCs of financing planning and work out your budget using our financial tools.

Incorrectly filled applications lead to last-minute unwanted hassles and may also lead to rejection of loan application. Keeping this in mind, DHFL has a separate scheme for those living abroad. DHFL NRI Home Loans, offer attractive rates of interest and facilitate a variety of needs such as purchasing a home, buying a plot, renovation, etcetera. With DHFL’s International Representative Offices offering an easy – to – apply home loan, as long as you are an Indian, location doesn’t matter.

The study looked at blood drawn from 767 nondiabetic people who had recently had a heart attack. They used the data to predict outcomes for the study participants and found that those with high levels of HDL and C-reactive proteins were a particularly high-risk group for heart disease. Research published by the journal Arteriosclerosis, Thrombosis, and Vascular Biology found that people with high levels of C-reactive proteins after having had a heart attack may process high HDL negatively.

When the allowed CPF amount is used up, you have to pay for the balance purchase price and/ or the monthly mortgage instalments in cash. Use the sale proceeds calculator to work out how much cash proceeds you need to use for your flat purchase. Be sure to secure sufficient financing before committing to sell your current flat or buy another one.

However, in some cases, Daily Reducing Basis may also be taken into account. Nobody wants to lend money to a borrower who is not credible. Credibility is an important factor which lenders take into account while deciding whether to process a loan application or not. However, only income does not fulfill the eligibility criteria alone. The applicant, if he is salaried, must have experience and regular flow of salary of more than 2 years. For self – employed persons, their business stability and flow of income of more than 5 years.

No comments:

Post a Comment